Can the European Biofuel Industry Survive the Shift to E-Fuels?

European biofuels face a constrained future, outpaced by scalable e-fuels—yet without cheap, clean electricity, even the synthetic alternative risks faltering in the global energy race.

Structural Challenge

The near-term setup for European biofuels has improved. But when looking past the horizon of near-term policy mandates, the long-term outlook becomes more difficult to read. What kind of role will these fuels play in a system where e-fuels, electrification, and synthetic pathways are rapidly gaining traction? The sector may not be fading — but it is being outflanked.

That’s partly because biofuel production is structurally constrained. Feedstocks — used oils, fats, residues — are limited. They don’t scale easily. As demand grows, costs rise, and the ceiling comes into view. The sector can’t lean on learning curves the way solar or batteries can. More demand simply pulls harder on a finite supply base.

In theory, policymakers could expand the list of eligible feedstocks — palm oil, for instance, or food-based crops like corn and sugarcane. But doing so undermines the core idea of sustainable fuels. The EU has already drawn a line, banning palm oil-based biodiesel due to deforestation concerns. That line has held so far. Whether it continues to hold under commercial pressure is a live question.

Structural Endgame

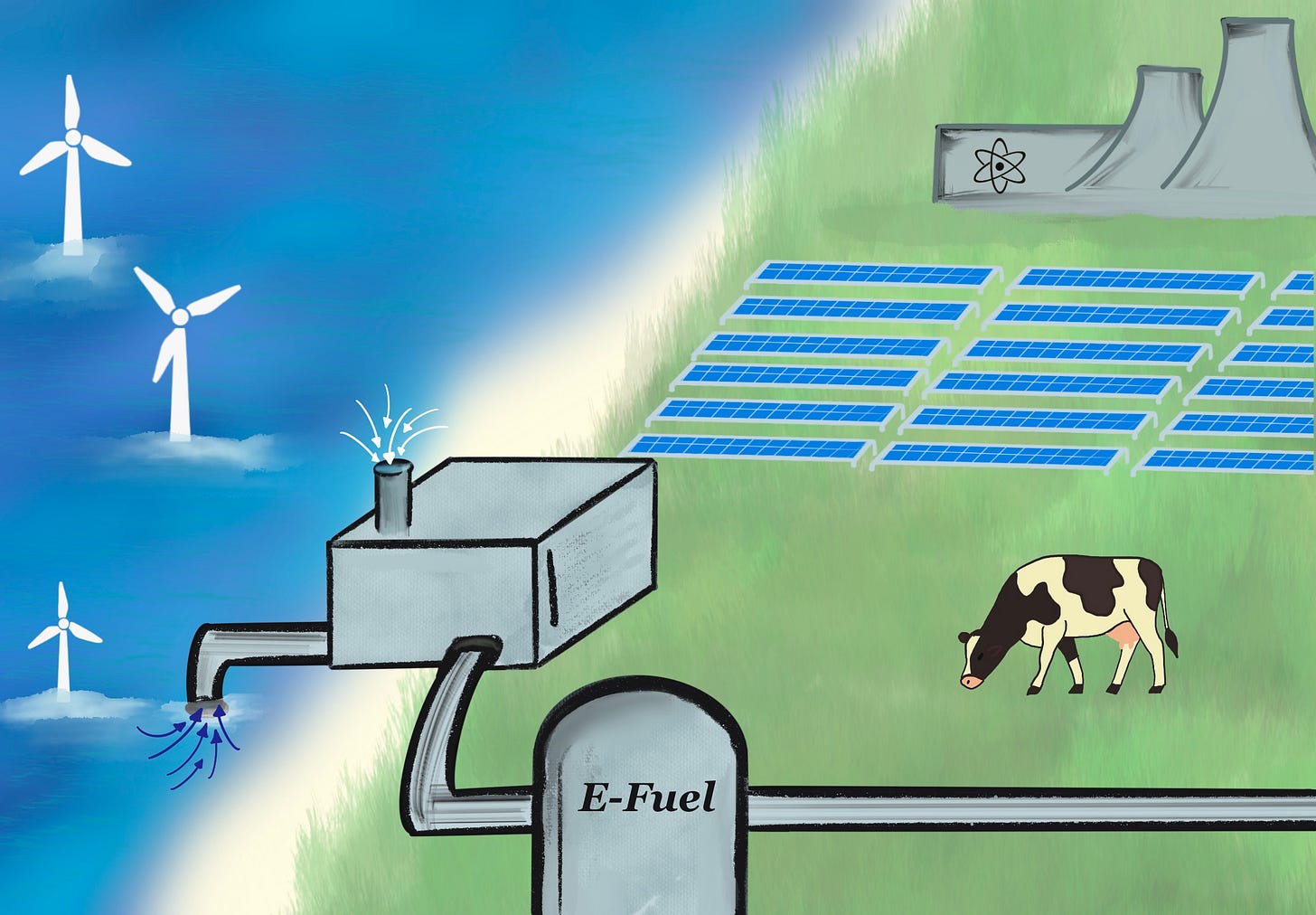

E-fuels — including synthetic SAF (e-SAF) — are designed to solve the scalability problem by using renewable electricity to create hydrogen from water, and capture CO2, to synthesize drop-in fuels with no feedstock limitations. They also align more closely with long-term climate goals: e-fuels can be carbon-neutral, do not compete with food production, and avoid the deforestation and traceability concerns that have plagued parts of the biofuel supply chain.

The EU has already begun planning for this transition. Under current rules, 50% of all SAF supplied in 2050 must be e-SAF — a clear signal that Brussels sees synthetic fuels as the long-term solution.

But here lies the next structural challenge: electricity cost. Europe has some of the highest industrial power prices in the world — often double those in the U.S., and far higher than those in energy-rich regions. Since electricity accounts for the majority of e-fuel production cost, this places European producers at a serious disadvantage.

This disadvantage, however, is not necessarily permanent. Europe’s high power prices in recent years have been driven by its former dependence on Russian pipeline gas, followed by a shift to imported LNG, which is more expensive and volatile. But that picture is changing. A global LNG supply glut is beginning to take shape, which could help bring down gas-linked electricity prices in Europe over the next several years.

At the same time, Europe is expanding its domestic low-carbon generation. Countries like France — which operates a nuclear-heavy grid — already have electricity prices below the EU average, offering a clear signal that co-locating e-fuel production near nuclear plants could materially reduce costs in the EU. Offshore wind capacity in the North Sea is also growing, and future projects may be developed specifically to serve e-fuel facilities outside the grid.

In the future, a grid that relies heavily on renewable generation could support hydrogen projects by providing access to electricity that would otherwise be curtailed—at a much lower cost than the average electricity price. In this way, even after the abysmal energy conversion losses inherent in hydrogen production and use, hydrogen salvages energy that would otherwise be cast aside through curtailment.

To compete globally, Europe will need to either develop dedicated low-cost electricity projects (e.g., nuclear-to-fuel or offshore wind-to-fuel infrastructure), leverage policy tools to protect and subsidize domestic e-fuel production, or, pursue external production zones — for example, in North Africa — where solar resources are strong and transport costs back to Europe are low.

In short, e-fuels eliminate the biofuel feedstock bottleneck, but replace it with an electricity bottleneck. Without a strategy to overcome that constraint, European e-fuel producers may struggle to survive in a global market increasingly dominated by low-cost players in more favorable geographies.

Transition Risk

The companies most at risk in the shift to e-fuels are those that fail to secure a long-term cost advantage. While legacy biofuel producers may have infrastructure and offtake relationships, they were built for a feedstock-based world — not one defined by electricity, electrolysis, and synthetic fuels.

The key bottleneck in this transition is electricity cost. Another could be CO2 access. CO2 access — whether via biogenic waste, DAC, or ocean capture — may remain a near-term constraint, but over time it is likely to commoditize as infrastructure and policy catch up. The defining edge in e-fuel production will not be who controls CO2 — but who controls cheap, clean, abundant electricity.

One potential wildcard in this transition is the use of blue hydrogen — hydrogen produced from natural gas with carbon capture. While cheaper than green hydrogen today, it remains controversial. In countries like the U.S., where natural gas is abundant and policy is more accommodative to the fossil fuel industry, blue hydrogen may emerge as an interim feedstock for SAF. But in Europe, the calculus is different.

The EU already imports most of its natural gas — increasingly in the form of expensive LNG — making blue hydrogen not just environmentally questionable, but strategically unattractive. Supporting blue hydrogen for SAF would amount to subsidizing imported fossil fuels while undermining Europe’s goal of building a resilient, low-carbon energy base. By contrast, green hydrogen offers a path to domestically manufactured e-fuels — expensive today, but with falling cost curves and stronger alignment with the EU’s energy and climate priorities.

That is not to say that blue hydrogen could not play an important role in the transition. More advanced blue hydrogen technologies—such as methane pyrolysis—could offer a very low-emission alternative and allow hydrogen demand to develop more fully before a proper shift toward green hydrogen begins. Natural gas reserves within EU borders could also play a more substantial role in the transition by shifting production toward the delivery of blue hydrogen instead.

What This Means

Despite the high electricity cost, there are scenarios in which Europe could succeed: co-location with nuclear plants (e.g. in France), offshore wind-to-e-fuel development (e.g. North Sea), behind-the-meter renewable setups that bypass high grid prices, and strategic partnerships abroad, including in solar-rich regions like North Africa.

Combined with industrial policy and energy security goals, these strategies could support a local e-fuel industry. But they require coordination, capital, and regulatory clarity.

For European producers, the strategic questions are multiplying. Do they double down on biofuels now and use the current policy window to reinvest? Or do they start pivoting toward e-fuels — acquiring location and cheap electricity access, and developing scale before competitors can?

Most players are still watching and waiting. The transition is costly. The demand curve is policy-driven. And timing matters. Enter too early and risk margin compression. Enter too late and risk losing access to offtake agreements and supply contracts. The clock is moving, but not everyone agrees on when to jump.