Carbon Capture Opportunity: The Path to a Sustainable Future?

Does the rising interest in carbon capture present a strategic opportunity for tech companies to offset emissions and advance sustainability?

Why it’s needed

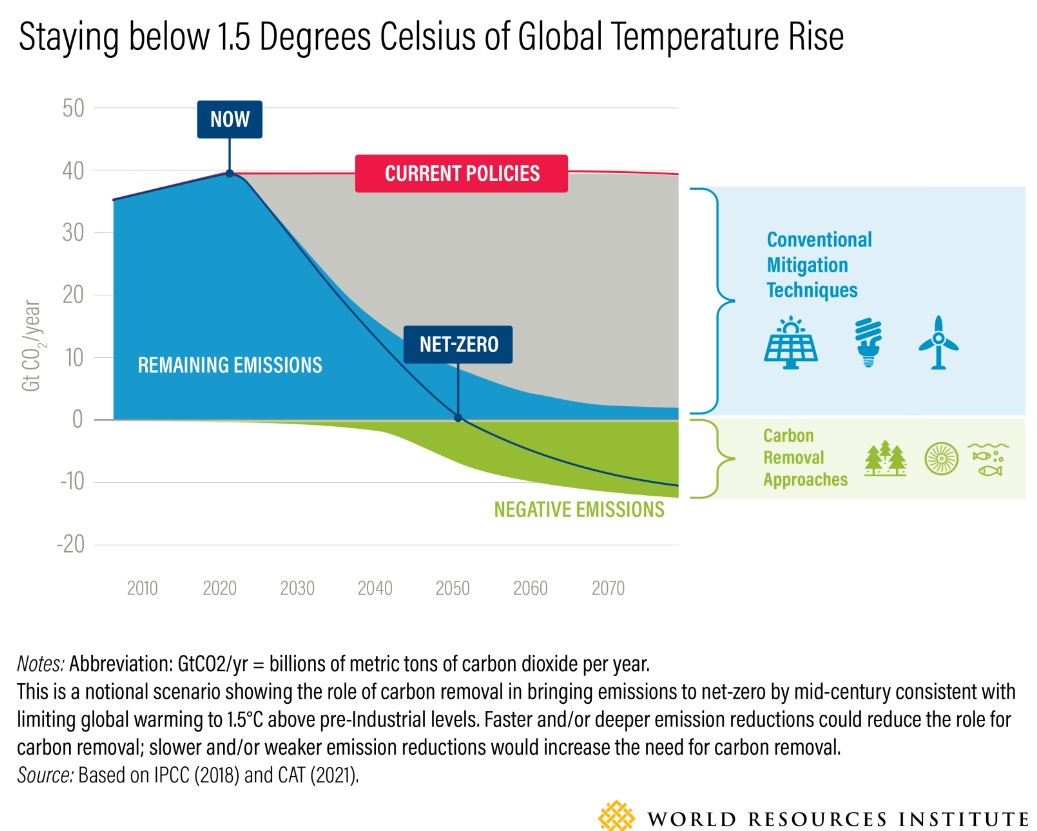

The IPCC has unequivocally concluded that Engineered Carbon Removal (ECR), such as Direct Air Capture (DAC), will be a vital part of limiting global warming to 1.5°C (source). But, it stresses that ECR is no substitute for reducing carbon emissions across the broad spectrum of energy use; rather, it will play a crucial role in decarbonizing hard-to-abate sectors. More critically, ECR will be essential in the longer term to counterbalance the significant accumulation of anthropogenic emissions already in the atmosphere—emissions driving today’s warming. Negative emissions technologies provide a means to remove these “legacy emissions,” offering the potential to slow, or even reverse, the rise in global temperatures.

Rising Global Interest

Interest in Carbon Capture and Storage (CCS), a type of ECR, along with DAC, has surged globally in recent years. Unlike nature-based solutions, CCS offers a distinct technological approach to reducing carbon emissions. CCS involves capturing CO2 from an emitting source, such as a power plant, and storing it permanently. In contrast, DAC uses large machines to capture CO2 from the atmosphere, which is then stored.

Current CCS capacity, and DAC to a much smaller extent, represents only a fraction of what will ultimately be required. Estimates vary, depending on the pace of the energy transition and emissions reduction, but several IPCC scenarios suggest that around 10 billion tonnes of CO2 will need to be captured annually by 2050. While not all of this has to come from engineered solutions, most IPCC decarbonization pathways emphasize the need for them (source). But the scale-up required from today’s capacity is immense (source).

DAC is considered a more sustainable approach than CCS because DAC removes existing CO2 from the atmosphere, offering a solution for negative emissions, while CCS primarily mitigates new emissions and often supports fossil fuel infrastructure. DAC is seen as more flexible, scalable, and better aligned with long-term decarbonization goals.

CCS at a power plant that burns new biomass for energy becomes - Bioenergy with Carbon Capture and Storage (BECCS). In BECCS, trees absorb CO2 from the atmosphere as they grow, and when the biomass is burned for energy, the resulting CO2 emissions are captured and stored underground. This process can result in net-negative emissions.

DAC is perhaps the least controversial approach.

Costs

Cost is a critical factor. Currently, DAC cost ranges from $600 to $1,000 per ton of CO2, far above the $200 per ton needed for it to become a viable option. For comparison, solid waste disposal in high-income countries averages about $200 per ton (source). One of DAC's key advantages is its scalability—it is over 100 times more land-efficient than solutions like reforestation (source). Additionally, it offers straightforward verification of the amount of CO2 captured.

Costs are expected to decline. Unlike large infrastructure projects, DAC systems are modular, consisting of small units that can be stacked and scaled. Currently, these units are produced on a small scale, but mass production could sharply reduce costs. Energy expenses are also projected to decrease as the technology becomes more energy efficient. Many experts believe DAC costs could drop below $150 per ton by 2050 (source).

Obsticals to Scaling

Apart from cost, there is the question of demand. With sufficient government support for R&D to help mature these technologies, alongside a robust carbon market where credits can be sold at reasonable prices, these technologies have the potential to scale. But carbon markets that automatically create demand for carbon credits are not universal. In countries where they are lacking, companies with voluntary climate goals can help generate demand. Large tech firms and other companies, struggling to directly reduce emissions, are increasingly turning to carbon credits from carbon management companies to offset their emissions and meet near-term net-zero targets.

Microsoft, for example, recently signed a deal with Occidental Petroleum to purchase 500,000 carbon credits over six years. Occidental will use DAC at its West Texas site to generate these credits. Importantly, the captured CO2 will be injected underground without being used to enhance oil recovery—a common and controversial practice in the oil and gas sector (source). Microsoft, which has pledged to become carbon negative by 2030, faces growing challenges in reducing its emissions, with its carbon footprint expanding over the past four years. The company is also grappling with the need for more clean energy to power its growing AI business, a challenge that is affecting the entire tech industry. Purchasing carbon credits is one of several strategies adopted recently, alongside investments in nuclear energy, to tackle these energy demands. Amazon also signed a deal with Occidental last year to purchase 250,000 carbon credits over ten years (source).

Government Push

The U.S. has recently ramped up support for DAC and other carbon capture initiatives. Notably, the Inflation Reduction Act offers tax credits of up to $180 per ton of CO2 captured to DAC plants, while projects capturing CO2 from sources like fossil fuel power plants receive $85 per ton in tax credits. Oil and gas companies have stated that these incentives make simpler carbon capture projects more financially viable. These projects contribute to building the infrastructure for carbon transport and storage, which will benefit DAC initiatives both now and in the future (source).

The UK and EU have also been incentivizing the development of CCS projects. Their combined official target is to capture 554 million tons of CO2 annually by 2050, which represents 13% of the EU’s and 25% of the UK’s 2022 emissions (source).

Some countries are also opting to transport their carbon emissions for storage abroad. Sumitomo Corp. and Kawasaki Kisen Kaisha of Japan have launched a business to ship CO2 captured from Japanese businesses to Alaska for underground storage, with similar plans being explored for Australia. Alaska, with its ideal geological conditions, offers suitable underground storage for CO2 (source).

Opportunity

One advantage in the U.S. is the comprehensive government support for carbon capture initiatives, coupled with favorable geology that allows for large-scale CO2 storage underground. The deal between Japanese companies and Alaska exemplifies this potential—Alaska boasts a CO2 storage capacity of at least 50 billion tons, enough to hold 50 years’ worth of Japan's CO2 emissions. Additionally, the U.S. has a skilled workforce in the carbon industry - oil and gas, and decades of engineering expertise in the field.

For companies purchasing carbon credits from removal projects like DAC or other methods, the motivation can vary. Some are investing in these nascent technologies today, recognizing they will be essential to their business in the long run, despite the high costs. For others, like in the case of tech companies, clean electricity supplies - more specifically firm power - are becoming so constrained that burning natural gas to power AI data centers is often their only short-term option, with carbon credits allowing them to offset the resulting emissions.

A balance must be found between which methods tech companies choose - carbon capture, nuclear, renewables+battery, etc., and how much they can allocate to such projects. Having multiple options in the future will be a clear advantage. Diversifying solutions is key.

The hype surrounding options like nuclear energy for tech companies, especially as a solution for powering AI, is positive in that it channels much-needed investment into a supply chain that has stagnated in much of the Western world. This prepares the industry for future growth. However, it’s also important to acknowledge that due to years of stagnation, nuclear power will remain a limited option for AI in the short term. The long term is a different story.