Does Hydrogen Have an Investable Future?

Can hydrogen's transformative potential translate into opportunities for investors? Or is it just fool's gold?

Hydrogen’s Role in the Net-Zero Journey

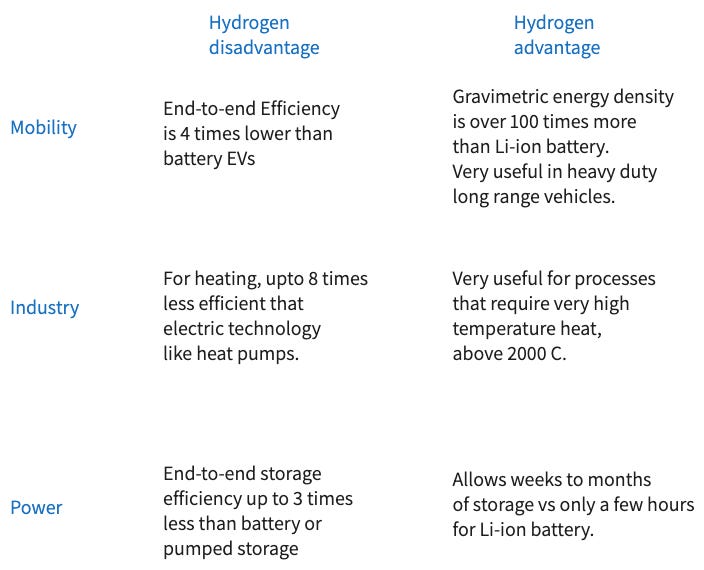

The most straightforward path to net zero might seem to be electrifying everything. But in reality, it is impossible to electrify every application—at least not all end uses.

For instance, long-distance air travel at today’s scale is infeasible with battery-powered planes. Jet fuel boasts a gravimetric energy density 50 to 100 times greater than even the best-performing batteries. This means a battery capable of delivering the same energy as jet fuel would weigh 50 to 100 times more. The same challenge applies to long-haul trucks and ships.

It’s not just about weight; the space required for such a battery would also be approximately 50 to 100 times greater than that of a diesel fuel tank in a truck or a ship. While it’s true that diesel engines convert about 40-50% of the energy in fuel compared to the 70-80% efficiency of electric motors, this improvement doesn’t negate the sheer magnitude of the challenge. These factors underscore the immense technical hurdles in electrifying such sectors.

Hydrogen offers a higher energy density than batteries but falls far short of diesel or jet fuel in terms of volumetric energy density—a crucial factor for ships and trucks. At 700 bar pressure, hydrogen's volumetric energy density is about six times lower than that of diesel. This means a vehicle would require six tanks of hydrogen to match the energy content of one tank of diesel. While this is a substantial increase, it’s far more practical for a truck than the roughly 100-tank equivalent space that batteries would require.

Liquid ammonia, which liquefies at approximately -33.3°C, has a volumetric energy density slightly more than twice that of hydrogen at 700 bar. However, producing ammonia from hydrogen is not a fully efficient process, making it viable only in specific scenarios.

Apart from its potential as a fuel, hydrogen is already widely used as a feedstock in numerous industrial processes and chemical production. It plays a critical role in industries such as ammonia synthesis for fertilizers, the production of methanol and other chemicals.

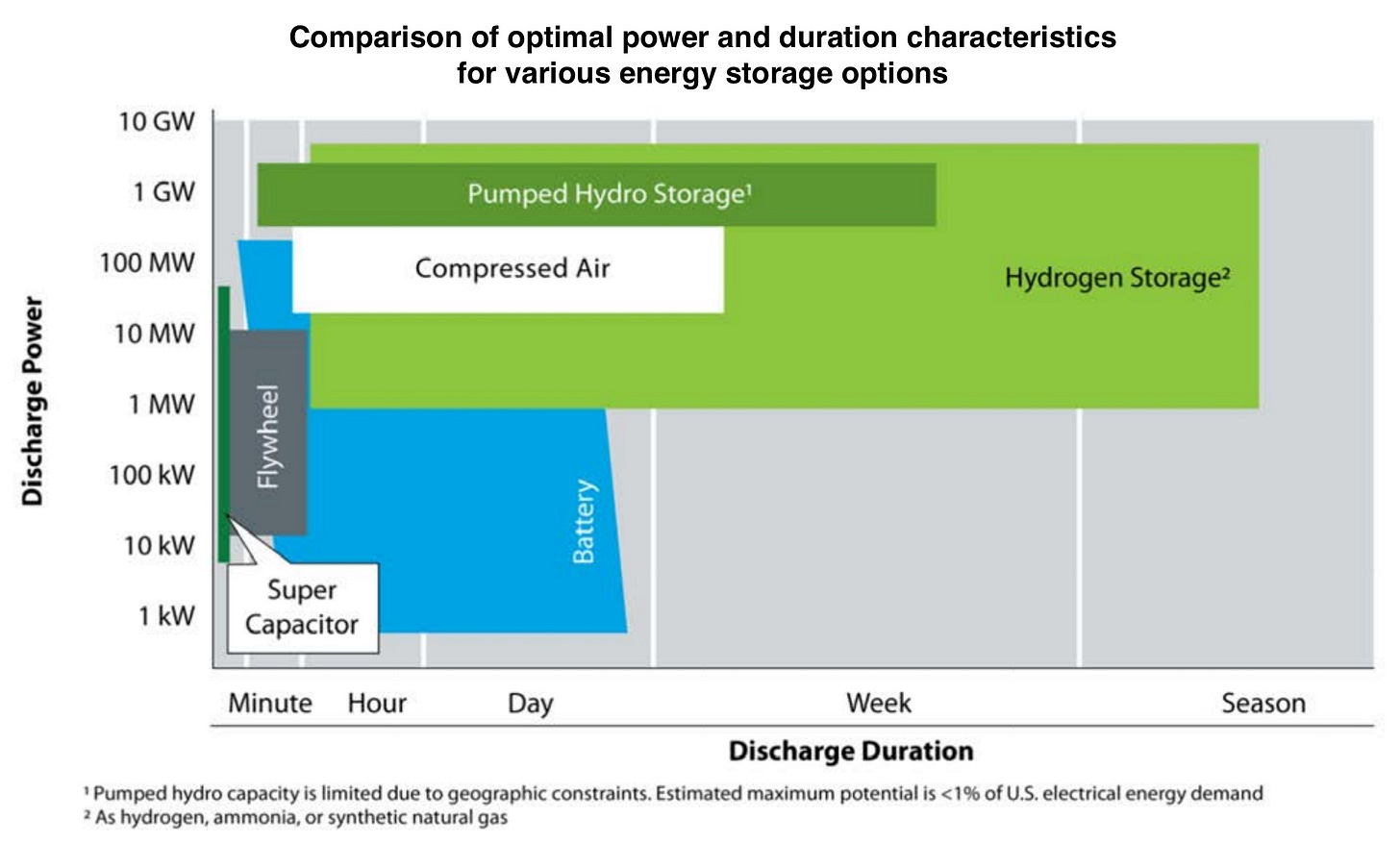

Hydrogen is also a strong candidate for long-term energy storage. Unlike battery systems, hydrogen storage does not degrade over time, making it better suited for preserving energy over extended periods (source). However, storing hydrogen comes with its own challenges—it is a difficult gas to contain, and leaks can be a significant issue that must be carefully managed (source).

The ability to store hydrogen—similar to how natural gas is stored today—and to produce it using only electricity makes it an attractive complement to intermittent renewable energy sources, helping to stabilize the energy system. Electrolyzers, which produce hydrogen from water, can operate flexibly, ramping up production during periods of excess renewable generation. Conversely, when renewable output falls short of demand for extended periods—when even battery storage might be insufficient—hydrogen can serve as a critical energy reserve.

Additionally, hydrogen storage is scalable: increasing storage capacity simply requires larger tanks, unlike battery storage, which require additional units for greater capacity. Hydrogen can even be stored in vast underground salt caverns, infrastructure already used by many countries for natural gas storage (source). Although less efficient and more expensive upfront, hydrogen may offer a key advantage: the ability to store large quantities of energy more affordably and for longer than batteries.

Green hydrogen remains costly today, but the declining price of electrolyzers and improving efficiencies signal a promising future. Electrolyzers, which are modular devices that scale effectively with production, are poised to follow a cost trajectory similar to solar panels and batteries, with significant reductions expected over time. Hydrogen also offers a distinct advantage as a drop-in fuel for existing systems. It is already widely utilized in industries like steelmaking and chemical production. Hydrogen-derived fuels, such as those for aviation and shipping, can seamlessly work with current airplanes and ships.

The Efficiency Challenge of Hydrogen Production

Hydrogen production from electricity inherently involves energy losses, making it an imperfect substitute for direct electricity use. In applications where electricity and battery systems are effective—such as in cars, home heating, or short-term storage—those should take precedence over hydrogen.

The process of converting electricity to hydrogen and back to electricity retains only 35-45% of the initial energy. However, in situations where renewable energy would otherwise be curtailed—this is after demand response has done all it can to balance the grid—resulting in a 100% loss, preserving 35-45% via hydrogen production becomes an attractive proposition, especially when factoring in hydrogen's additional benefits (source). If hydrogen is transported through pipelines and stored long-term, efficiency drops further to 30-40%. Most of this energy loss occurs as heat. While recovering this heat could improve system efficiency, it does not directly restore the energy content of hydrogen (source).

For global hydrogen trade, ammonia is likely to serve as the preferred medium. Converting hydrogen to ammonia and transporting it over long distances—typically useful only for distances over 1,500 km—leaves just 20-25% of the original energy intact. While that’s a small fraction, some regions have renewable energy so abundant and cheap that it could still work. If these countries produce hydrogen, convert it to ammonia, and ship it to far-off places where renewable generation is weak at certain times of the year and electricity prices are high, the ammonia or hydrogen arriving at those markets might still compete economically with other options. That’s the hope driving efforts in countries like Chile, Saudi Arabia, and Australia.

Ultimately, competitiveness depends on whole-system costs rather than efficiency alone. Hydrogen, even with significant losses, can be viable where its unique advantages outweigh the associated costs. Its role will likely be confined to areas where it is the most practical or the only feasible solution.

Uncertainty Clouds Hydrogen’s Path to Growth

Over the past four years, clean hydrogen—both blue and green—has experienced a wave of optimism. Global investments in hydrogen projects reaching the final investment decision (FID) have surged sevenfold, growing from 102 projects worth $10 billion in 2020 to 434 projects valued at $75 billion in 2024 (source).

Yet, despite this enthusiasm, the hydrogen industry has recently encountered a slowdown and uncertainty about its future. Several factors have contributed to the lethargy. Rising interest rates have hit green tech and renewable energy projects across the board, particularly those requiring significant upfront capital. Additionally, the cost equations for green hydrogen have shifted as its primary input—renewable energy—has become more expensive. Policy challenges, especially in the U.S., have further complicated the landscape.

The core issue with hydrogen lies in a mismatch between supply and demand. While investor confidence has driven substantial capacity-building over the past few years, demand remains weak and uncertain. High hydrogen costs and an unstable policy environment have made buyers hesitant to commit. Currently, there is more electrolyzer capacity available than actual demand (source), and only 12% of clean hydrogen projects have firm customer agreements (source).

On the international stage, the imbalance is even starker. Among countries with hydrogen strategies, 40 aspire to be exporters, while only 12 are positioning themselves as importers (source). This "build it and they will come" mentality risks creating stranded assets, akin to China’s infamous ghost cities, if demand fails to materialize.

To avoid this scenario, policymakers must shift their focus toward stimulating demand. Without robust and stable demand, confidence will falter, and the industry’s growth could stall despite its potential to drive the energy transition.

Hydrogen Positioned as a Vital Element for Net-Zero Success

The lack of optimism about hydrogen may be misplaced. It seems poised to be an essential ingredient in achieving net-zero goals.

Today, the world consumes around 90–100 Mt of hydrogen per year, nearly all of it produced from fossil fuels. Looking ahead, estimates for future hydrogen demand vary widely, depending on how the next 30 years unfold. On the optimistic side, if we pursue net-zero goals with full conviction, hydrogen could see significant adoption. On the other, if it struggles to meet expectations, alternatives like biofuels could dominate aviation and shipping, while natural gas paired with carbon capture and storage (CCS) becomes more widely accepted. This leads to projections of 2050 clean hydrogen demand (green and blue) ranging from 125 Mt to 585 Mt (source).

We’ll likely land somewhere in the middle of this range, but whether hydrogen fulfills its potential will depend on how committed we are to realizing its promise.

A significant portion of the hydrogen demand projected for 2050 in a Net Zero scenario will come from sectors that are challenging to electrify—iron and steel production, aviation, and shipping—alongside sectors like the chemical industry and fertilizer production, where hydrogen serves as a direct input. If the world achieves its net-zero ambitions, roughly 400 Mt of clean hydrogen will be needed annually by 2050, with an intermediate target of 150 Mt by 2030 to stay on track.

However, the current outlook falls alarmingly short. By 2030, only about 15 Mt of clean hydrogen might be available at best (source). This isn’t due to a lack of electrolyzer capacity but a striking gap in demand. Despite numerous hydrogen projects being announced, buyers remain scarce—a stark example of policy failure.

This shortfall doesn’t necessarily signal a bleak future for the hydrogen industry itself. Instead, it highlights a broader challenge: the world is failing to mobilize the demand, investment, and coordination needed to meet its net-zero targets.

Hydrogen’s Future Hinges on Clear Policies and Strategic Investment

One key uncertainty in the hydrogen landscape is the lack of consistent and clear long-term policy signals. In some cases, natural gas remains a direct competitor to hydrogen, particularly without strong policy support. For instance, researchers have noted that it may currently be cheaper to use natural gas for energy and pair it with carbon capture and storage (CCS) (source). In industries like shipping and trucking, where liquefied natural gas (LNG) can serve as a fuel alongside direct air capture to offset emissions, the economics may currently favor natural gas over green hydrogen.

This uncertainty around policy and economics creates hesitation among buyers considering investment in hydrogen infrastructure, which remains expensive and untested at scale. The question persists: will being an early adopter of hydrogen prove to be a competitive advantage, or will it burden first movers with sunk costs in infrastructure that may be outcompeted or unsupported?

What is clear is that hydrogen will be a part of the energy future—but whether that future arrives sooner or later depends heavily on policy action. To unlock its potential, governments and industry must provide stronger incentives and clearer direction, particularly in sectors where hydrogen can have the greatest impact: iron and steel, chemicals and fertilizers, shipping, long-haul trucking, and long-duration seasonal energy storage. Without such action, the hydrogen economy risks being delayed, leaving its transformative promise unrealized.

Data! data! data!

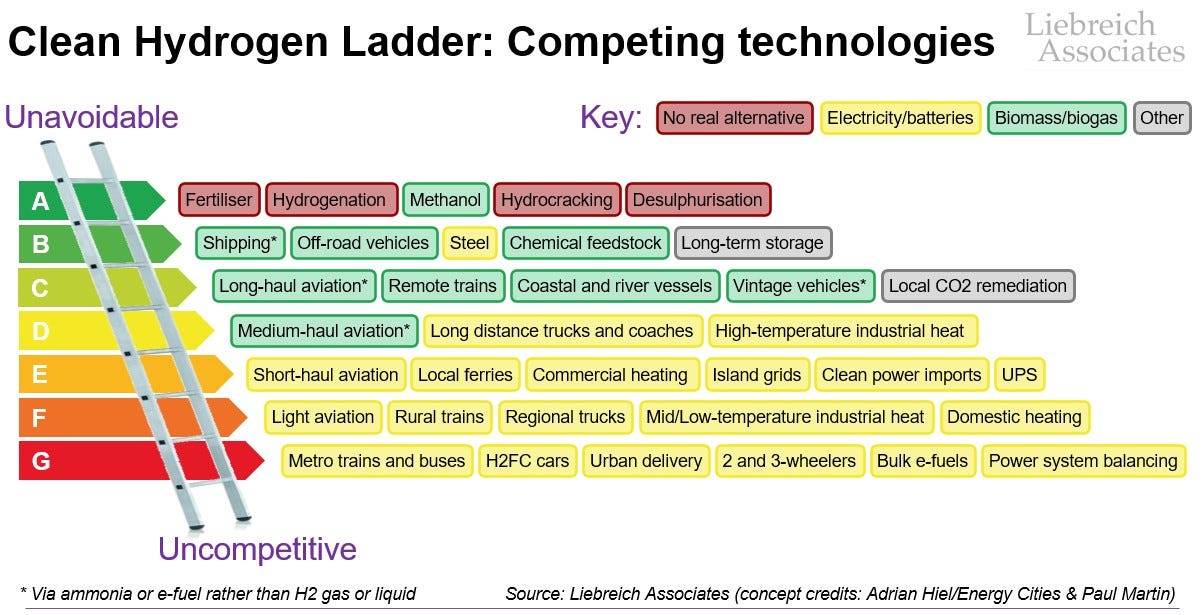

This chart by Michael Liebreich, titled the "Clean Hydrogen Ladder," underscores two key points. First, it identifies priority sectors where hydrogen deployment is most critical. At the top are areas where hydrogen use is indispensable, requiring green hydrogen production to achieve carbon neutrality. As one descends the ladder, hydrogen's competitiveness diminishes, with alternative technologies emerging as more viable solutions for decarbonization.

Second, the color-coded key in the top-right corner highlights hydrogen's primary competitors across various sectors. In many cases, biomass and biogas present the most significant alternatives to hydrogen. Projections for future hydrogen demand vary widely, reflecting uncertainty about how extensively these competing technologies can advance. Policymakers are likely to support both hydrogen and biomass/biogas, valuing the diversity of options they offer to bolster energy security and resilience.