Electric Dreams Deferred: Challenges in Sustaining EV Momentum

EV market in the US and EU faces a significant slowdown due to shifting consumer preferences, reduced subsidies, and market pressures, challenging automakers' ambitious electrification plans.

Slowdown in EV demand in the US and EU

Growth expectations for electric cars were built over the past four years on strong customer demand, robust policy support, and the urgent need to electrify all new vehicles by the 2030s. Tesla’s strong stock performance in 2020 and 2021 signaled to many car companies how embracing EVs early could impact them, with its stock growing over tenfold in just two years. Marketing themselves as "Teslaesque" became the simplest way for auto companies to boost their stock prices. It seemed like the perfect time to throw caution to the wind and go all in. That was a different time and a different place, yet it feels as if it were just around the corner.

Auto companies positioned themselves to capitalize on shifting consumer preferences and a growing willingness to embrace a major transition to EVs. Ambitious investment plans were announced by all major manufacturers, with iconic models like the Mustang, F-150, Hummer, and VW Van reimagined as EVs—sporting bold designs and flashy, tech-laden interiors. These weren’t just cars; they were visions of the future—vehicles that felt more like prototypes than the worn-down models typically marketed to the average buyer. Look no further than the Tesla Cybertruck, where the absurd meets the thrilling, evoking the excitement of a childhood dream brought to life - the concept car you could actually own.

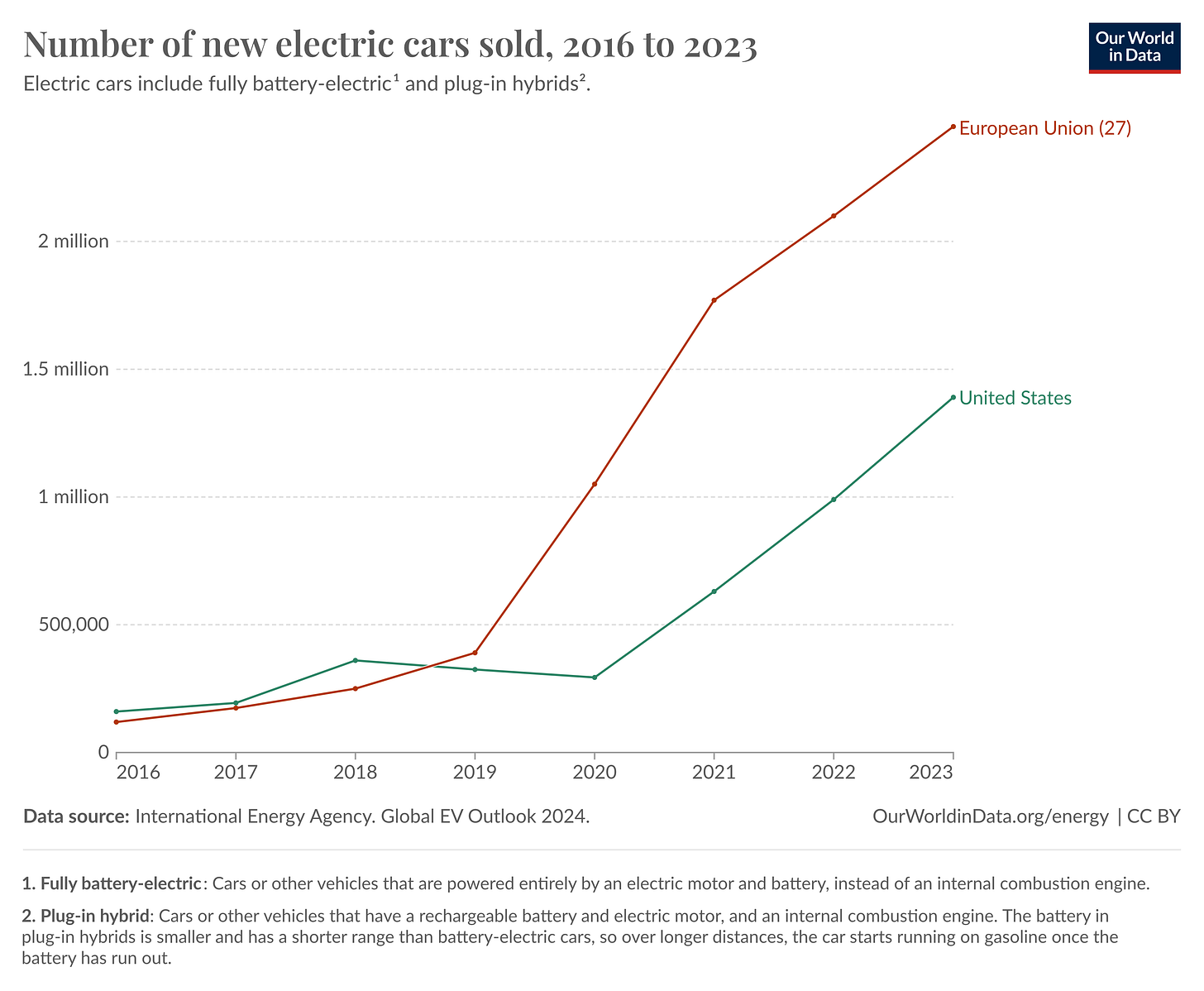

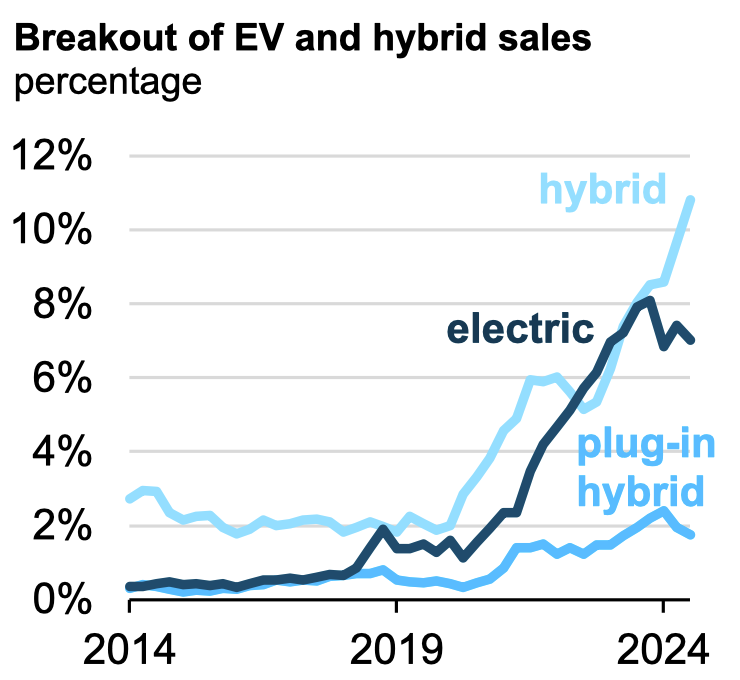

Sales of battery electric vehicles (BEVs) had been growing robustly in the U.S. since the COVID-19 pandemic, but since early 2024, growth has slowed significantly. Buyers are now leaning more toward purchasing hybrid electric vehicles (HEVs). This abrupt shift has surprised many who had grown accustomed to ballooning enthusiasm for BEVs over recent years. While long-term BEV growth remains certain, the slowdown in growth pace signals potential short-term challenges for automakers already grappling with a host of other pressures.

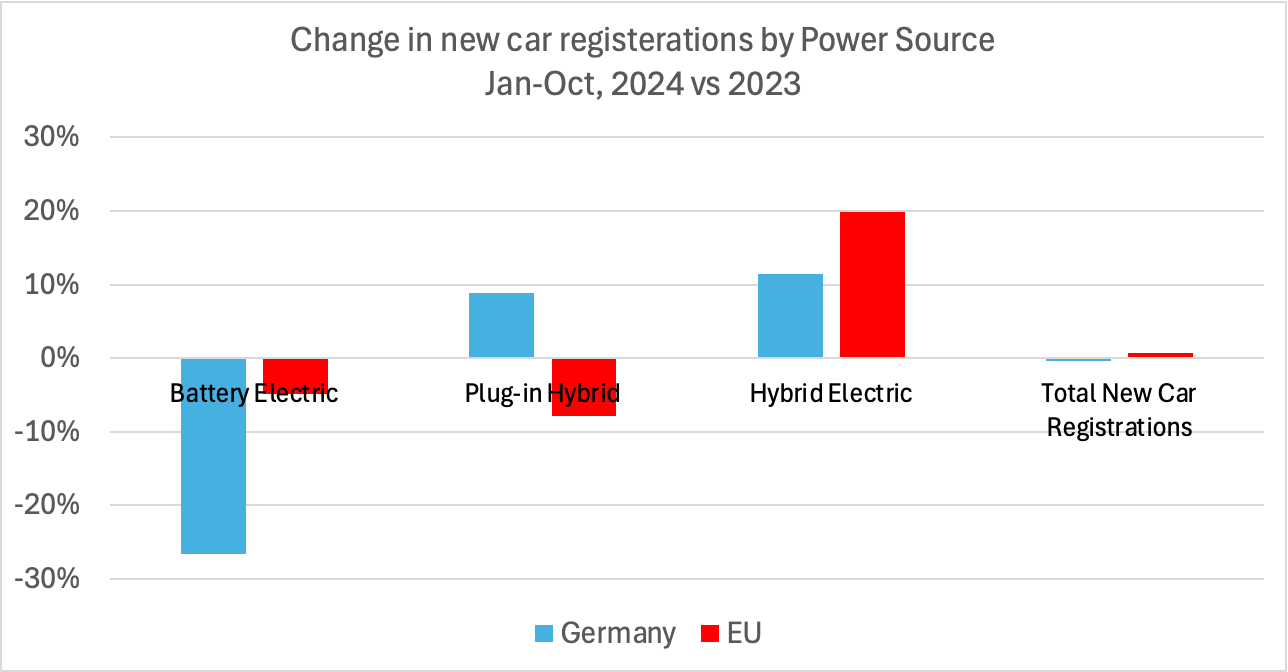

The trend isn’t limited to the U.S. In the EU, BEV sales from January to October 2024 were down 5% compared to the same period in 2023. The impact is even starker in Germany, where the withdrawal of EV purchase subsidies in late 2023 contributed to BEV sales from January to October 2024 to fall by 27% compared to the same period in 2023. Here too, the shift favors HEVs over BEVs and plug-in hybrids (PHEVs). HEV sales in the EU surged by 20% during the same period.

Used EV falling prices have hurt new EV sales

During the pandemic, used EV prices—including both BEVs and PHEVs—soared as supply chain disruptions made new EVs more expensive and difficult to obtain, with long wait times compounding the problem. Over the past two years, however, prices for used EVs have plummeted, mirroring a general decline across the used car market. Yet, the drop for EVs has been particularly sharp—falling nearly 25% over the past year, a rate 4.4 times faster than equivalent gasoline models. The decline in 2023 was even more dramatic.

Several factors have fueled this trend. A stabilizing supply chain allowed for greater availability of new vehicles. Additionally, the introduction of the Used Clean Vehicle Credit in January 2023—which offered up to $4,000 in tax credits for used EVs priced under $25,000—created a powerful downward pull on prices for used EVs above that threshold.

These falling used EV prices reshaped the market. They increased the total cost of ownership for new EVs, prompting many buyers to favor used models over new ones. Tesla's aggressive price cuts—25% on average across its lineup—on new cars pressured competitors to follow suit, worsening losses for manufacturers already struggling to make profits on new EVs.

In response, many automakers have scaled back their ambitious EV plans. Ford, for instance, recently halted production of its flagship F-150 Lightning, warning it could lose $5 billion this year on battery-powered models. Meanwhile, the average transaction price for new EVs in August 2023 was 13% lower year-over-year. By August 2024, the decline had slowed to just 1.2%, signaling a potential stabilization of prices.

Government support still necessary for EV adoption

The debate over government intervention to support EV demand in the U.S. and EU continues, but one reality remains clear: EVs have yet to achieve price parity with gasoline-powered vehicles in these markets. Currently, EVs cost 10% to 50% more than their gasoline equivalents, with parity unlikely to be reached before 2030. This price premium has kept EVs firmly within the luxury category. In the U.S., 70% of all BEVs sold are classified as luxury vehicles, and in 2023, 55% to 95% of EVs—including PHEVs and HEVs—were large models, largely unaffordable for the average consumer.

Government subsidies have played a critical role in accelerating EV adoption by reducing the upfront cost for buyers. However, these policies also underscore the market’s reliance on financial support. This was evident in Germany, where the abrupt removal of EV purchase subsidies in late 2023 is projected to result in a nearly 30% drop in EV sales this year. France has followed suit, cutting EV subsidies by over 30%.

In the U.S., the Biden administration introduced significant incentives to encourage EV adoption. Basically, qualified new car buyers can earn credit upto $7,500 and qualified used car buyers can earn credit upto $4,000. This applies to a large majority of buyers, but not all of them. Meanwhile, the incoming Trump administration has frequently mentioned plans to eliminate these subsidies, prompting several automakers to openly advise against such a move.

In the absence of price parity, uncertainty around government support creates hesitancy among consumers. Many prospective buyers are likely to postpone their EV purchases, waiting for clearer signals or the next buying cycle before committing to switch from gasoline vehicles.

Range anxiety is still hurting EV adoption

The original conundrum of electric vehicles—why buy an EV if public chargers are scarce, and why build chargers if no one owns EVs—has faded as infrastructure and adoption have grown. Yet, the root cause of that dilemma—range anxiety—remains unresolved for many prospective buyers. Despite improvements, this lingering fear still deters a significant portion of consumers from switching from gasoline to electric vehicles.

A 2022 McKinsey survey revealed that 80% of potential EV buyers and 70% of current EV owners are dissatisfied with the availability of public charging infrastructure. Public charging, though critical to overcoming range anxiety, has not been pivotal for most current EV owners. Only a quarter to a third of them rely on it, with the majority charging at home. This reflects the demographics of early adopters: EV buyers have predominantly been higher-income individuals with private parking, where home charging is both accessible and convenient. It aligns with the fact that 70% of BEVs sold in the U.S. fall into the luxury category.

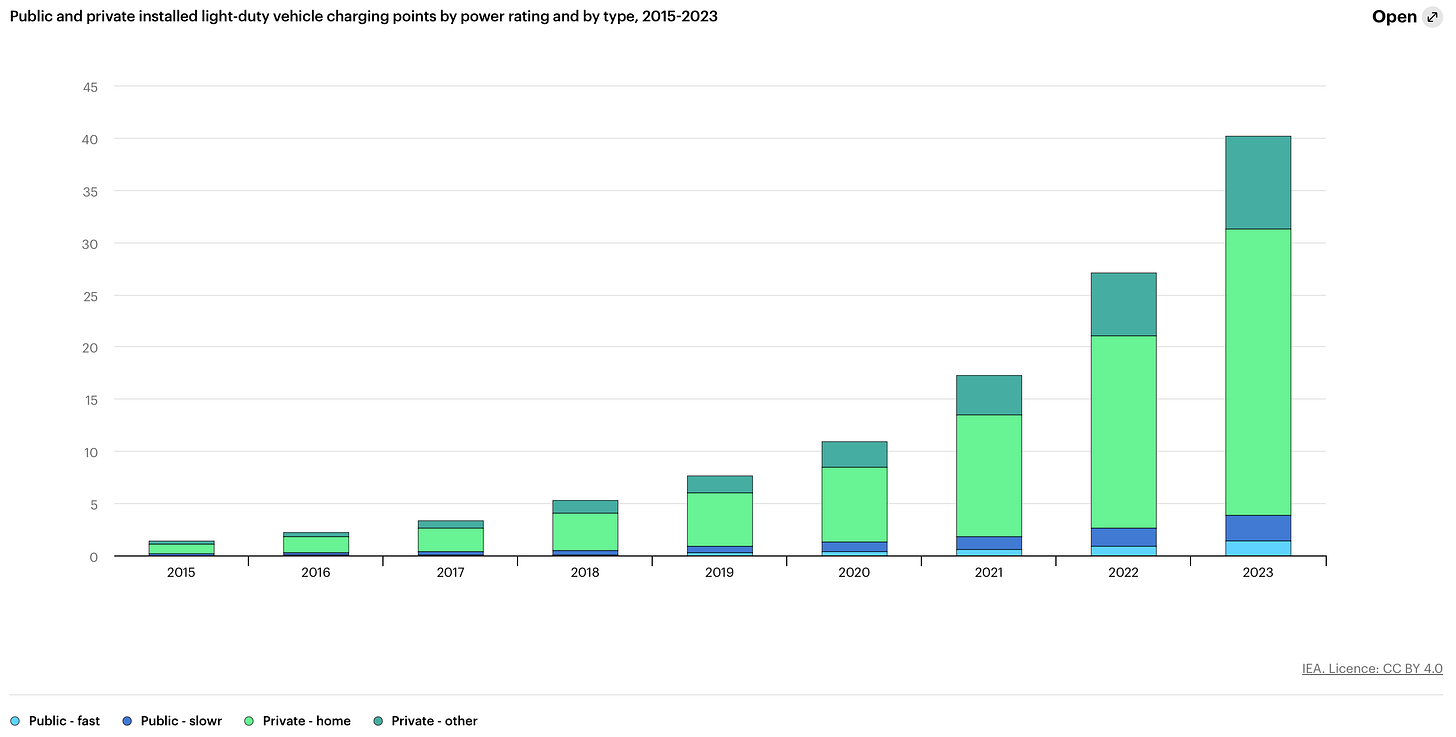

However, as EV adoption scales and penetrates broader market segments, public charging will play a far greater role. Among those surveyed by McKinsey, 42% of non-EV owners lacked the ability to charge at home, compared to just 17% of EV owners. This underscores the critical importance of expanding public charging infrastructure to address range anxiety and enable the next wave of EV growth.

Yet expansion must be thoughtful. Charging station experiences will heavily influence public perception. For those using or considering public charging, speed and cost rank as the top priorities, followed by concerns about safety and charger reliability. Faster charging can alleviate some of these issues, such as reducing the likelihood of crowded stations or long queues. Addressing these factors holistically is essential to building confidence in public charging and mitigating range anxiety as the market evolves.

Increasing the number of public chargers can do more than just alleviate range anxiety; it may also make smaller batteries with shorter ranges more acceptable, reducing dependence on critical minerals. This shift could significantly impact the sustainability and cost of EV production, allowing automakers to offer more affordable options.

As range anxiety remains a significant barrier to further EV adoption, automakers that can transform the public charging experience stand to gain a competitive edge. Whether through faster charging infrastructure, battery technologies that extend range, or better-placed and more abundant charging stations that reimagine the "gas station" experience, companies that excel in addressing this challenge will attract more customers. Addressing range anxiety remains crucial to unlocking the next phase of growth.

Despite the recent slowdown, one reality remains unchanged: automakers must develop strategies to outpace competitors in an all-electric future. The transition to an all-BEV world is inevitable. It may arrive later than anticipated or accelerate unexpectedly, but the real competitive threat for most western companies in a world driven by EVs is Chinese EV companies.