Is There a Case for Using Hydrogen for Seasonal Storage?

Hydrogen might offer a cost-effective, scalable solution for long-duration energy storage in renewable-heavy systems, especially for addressing seasonal imbalances.

We use nearly 100 million tonnes of hydrogen each year today, almost all of it derived from fossil fuels and accompanied by CO2 emissions. Some estimates suggest that by 2050, global demand could grow fivefold — and all of that would need to be low-emission to align with net-zero targets. Hydrogen today is essential for making fertilizers, plastics, and paints, and it plays a significant role in petroleum refining. In the future, its use could expand into sectors like transport, industrial heat, steelmaking, and energy storage. That future isn’t guaranteed — but it’s plausible enough to warrant serious attention. This insight focuses on one specific question within that broader context: whether hydrogen makes economic sense as a long-duration energy storage solution.

Producing low-carbon hydrogen is not easy or attractive — especially when the goal is to use it as an energy storage medium rather than a feedstock. When hydrogen is the required input, such as in fertilizer production or steelmaking, inefficiency in production is tolerable. But when hydrogen is just an intermediary — a way to store electricity and convert it back later — then every step matters. Converting electricity to hydrogen and back to electricity can result in a round-trip efficiency of just 40–45%. That trade-off may still be worth it under certain system conditions — but the bar is high. You need a strong reason to accept that level of energy loss.

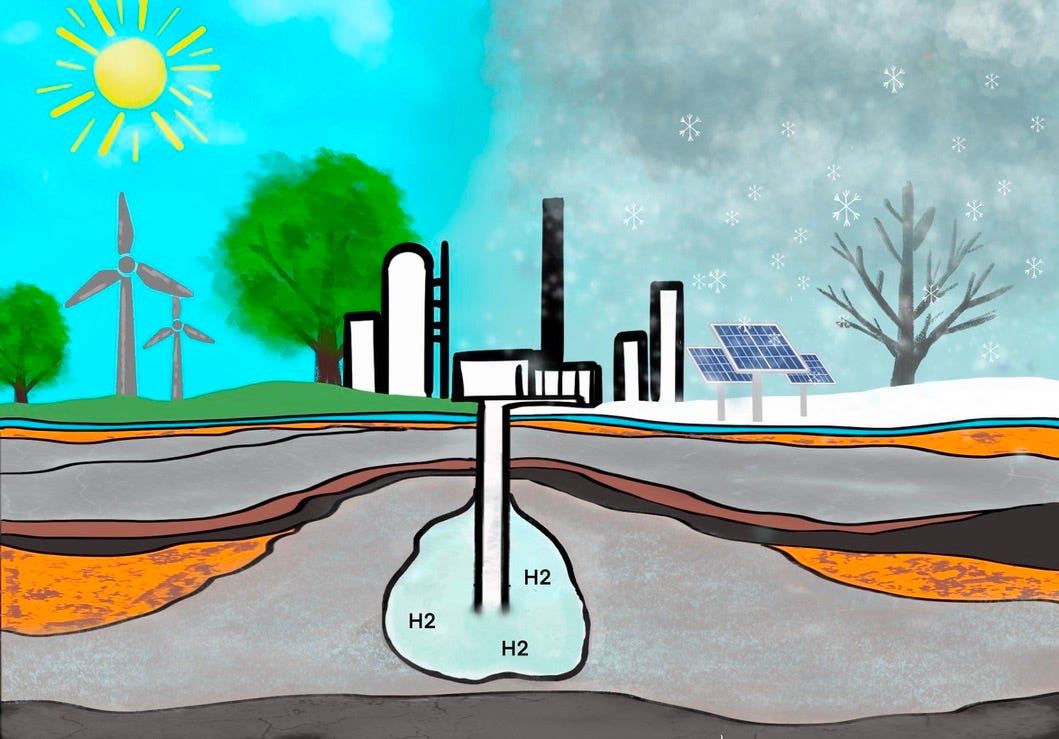

For long-duration, infrequent storage — the kind needed to cover seasonal shortfalls in renewable generation — hydrogen has a structural cost advantage over batteries. Battery storage scales linearly with materials: more storage means more lithium, more cells, more capital. Hydrogen storage, by contrast, can scale with space. In salt caverns, marginal increases in storage volume are just that — additional empty volume, not additional material. And in the EU, salt cavern capacity is not a major constraint.

That’s why hydrogen starts to look appealing when we think in terms of months or seasons rather than hours or days. Batteries, for all their round-trip efficiency, become economically punishing when used to store energy that may only be discharged once a year. Hydrogen infrastructure is also underutilized in such cases — but the capital intensity is lower, and the marginal storage cost is dramatically cheaper.

Hydrogen’s role might become to complement a grid that is increasingly shaped by weather. As the share of variable renewables grows, long-duration imbalances emerge from climate-linked generation patterns. Hydrogen’s ability to absorb surplus electricity and release it months later fills a structural gap that batteries and demand response, for all their strengths, aren’t designed to solve.

As renewable penetration increases, overbuilding becomes inevitable — and essential. In a system dominated by wind and solar, redundancy isn’t wasteful; it’s a prerequisite for resilience. To ensure year-round supply, you have to size capacity for the low-generation months. But that means in the high-generation months — long sunny days, strong seasonal wind — you’ll routinely produce more power than the grid can use.

Curtailment is the system’s way of dealing with this imbalance. But curtailment also represents wasted capital. That’s where hydrogen enters the picture — not as a perfect battery, but as a strategic sink. It absorbs the excess, smooths seasonal variation, and stores energy in a form that can be dispatched months later. Unlike batteries, hydrogen doesn’t require costly material scaling to increase duration. It can store energy at volume, cheaply, and indefinitely.

Batteries are excellent for intra-day balancing, even for multi-day shifts. But they don’t scale well across seasons. You don’t charge lithium-ion cells in the summer to discharge them in the winter — the economics simply don’t work. Hydrogen, though inefficient, allows you to shift abundance from one season to another. In this role, inefficiency matters less than timing and cost. If the alternative is wasting the electricity entirely, then recovering even 40% of it — months later, at peak prices — is a rational trade.

When it comes to long-duration, infrequent storage — the kind needed to cover seasonal shortfalls in renewable generation — batteries run into hard economic limits. You can build lithium-ion systems to buffer day-to-day volatility. But building them to store energy for months, only to discharge it once or twice a year, becomes prohibitively expensive.

At some point, duration changes the logic. There is a critical time threshold — determined by both the length of time energy must be stored and the frequency of its use — beyond which hydrogen becomes the superior option. That threshold isn’t fixed. It moves as technologies improve and prices shift. But for seasonal storage, we’re likely already past it.

To illustrate, consider a simple comparison.

A single Tesla Megapack costs about $1 million and stores 4 MWh of energy (source). To store 160 GWh of energy — enough to power roughly 750,000 U.S. homes for a week — would require 40,000 Megapacks, at a cost of $40 billion (source). That’s assuming perfect round-trip efficiency.

Now consider storing that same 160 GWh using hydrogen. To account for conversion losses (with round-trip efficiency around 40%), you’d need to produce and store the energy equivalent of 400 GWh. That amounts to roughly 12 million kilograms of hydrogen. At $5/kg for storage in salt caverns, including the compression costs, the storage cost totals $60 million (source).

You still need to produce the hydrogen and convert it back to electricity. Add another $60 million - at $5/kg - to produce it, and perhaps $1–2 billion for a dedicated gas turbine to dispatch it during peak demand. Even on the high end, the total system cost remains under $2.2 billion. That’s an order of magnitude cheaper than battery storage for the same purpose.

So this isn’t just about efficiency. It’s about system cost, capital allocation, and frequency of use. Spending $40 billion on an asset used once a season is economically irrational — even if it recovers 90% of input energy. Hydrogen systems lose more energy, but cost dramatically less to idle.

For this specific use case, hydrogen could be produced, stored, and consumed on-site. There’s no need for long-distance transport or grid-scale hydrogen pipelines. That keeps logistics simple — and cost controlled.

Here we assume the turbine is used primarily to convert stored hydrogen back into electricity. But in some cases, this turbine could also be paired with a thermal battery system, and hydrogen can act as the final dispatch layer once the thermal energy from the battery is exhausted. That coupling allows hydrogen to extend the duration of an otherwise short-duration thermal battery, while also leveraging shared infrastructure for electricity generation. The economics would improve when both systems are designed together. You could further colocate SAF production and steelmaking to use hydrogen for other purposes.

Even if the economics of hydrogen are still debated, the role it plays in a renewable-heavy grid is becoming more difficult to ignore. It may never match the efficiency of batteries, but it doesn't have to. Its value lies in duration, optionality, and structural fit — not perfection.