Why AI-Driven Electricity Demand Will Fuel a Lasting Comeback for Natural Gas

As AI accelerates energy demand, companies are turning to natural gas, carbon capture, and hydrogen to secure power while struggling to keep net-zero ambitions alive.

The rapid growth of artificial intelligence (AI) is reshaping the global energy landscape, driving unprecedented electricity demand. As AI data centers scale, energy constraints—particularly grid limitations—have become a critical bottleneck.

While decarbonization goals remain relevant, the immediate need for stable and reliable energy sources will likely lead to a resurgence of natural gas, supported by carbon capture and blue hydrogen technologies over the medium term.

Constraints

AI data centers require a complex ecosystem of components, from Nvidia chips and storage to network equipment and cooling solutions. Supply constraints in any of these components have the ability to hamper growth. But market signals often are able to self-regulate the supply so that any disruption is only short-lived.

The grid is not as flexible and not as adaptable to market signals. Grid expansion is a slow process, mostly because the grid over the past two decades had not needed to fulfill high demand growth. Moreover, compared to the construction time required for AI data centers, which could be as little as a few months, the grid and the power plants can take several years before they start delivering electricity.

So the regulatory process and long construction timelines, although suitable enough for an environment where electricity demand growth is flat, are quite unprepared to deal with the high demand growth environment we are entering now.

There is a high degree of uncertainty among grid operators because the situation is so unprecedented. This has really been a sudden shock to them. There is very little clarity on how fast or to what capacity they must expand. Is this a short-term blip—like a COVID-like event—or is this a permanent trend change?

They don’t know, for example, whether growth in AI data centers’ electricity requirements would be offset by improvements in efficiency—which, over the past two decades, have kept electricity demand growth near flat even though we use many more electronics and rely on the internet far more than we did back then.

The risk grid operators face in overestimating demand growth is that they could end up building excess supply, resulting in stranded assets that ultimately increase costs for the general user.

There would naturally be a tendency to resist such an outcome—to resist being overly accommodating to AI data center growth at the expense of the general user, and to resist creating a public outcry. AI companies would inevitably have more difficulty expanding this way than if they found a way to source their own energy. Several states are already pushing for more regulated data center energy use to protect consumers from higher prices.

Let’s not forget that AI data centers’ electricity demand growth is not the only issue grids are facing. The energy transition is causing rapid electrification of transportation and heating, and the onshoring of manufacturing is also expected to increase electricity usage.

Availability

Natural gas is available in abundance in the U.S. And the industry over the past decade has become quite capable and efficient too. The U.S. today produces more natural gas than Russia and Iran combined, which are the second- and third-largest producers in the world. U.S. LNG is also seen as important for Europe to rid it of Russian gas.

Globally, LNG is entering a period of supply glut, where over the next decade, much more supply is expected to enter the market than the available demand based on current uses. New demand from AI could end up absorbing the excess supply.

Acceptance

In the U.S., there has been growing public support for natural gas projects. Partly, it’s because it helps support European gas needs and reduces its reliance on Russia. But it’s also due to the broader push for energy security—reducing dependence on foreign actors like Russia and China, not just for oil and gas but also for the essential minerals needed in the energy transition.

The Trump administration calling for more drilling is, to an extent, echoing what the public also wants. With this shift in opinion—and now with the Trump administration fully supporting the industry’s growth—more investment will flow into natural gas production and gas-powered electricity generation.

This shift aligns with broader corporate trends, where ESG is increasingly weighed against financial performance rather than treated as an absolute priority. Investor interest in ESG investments has cooled substantially, with fund managers stepping back—not only because of the underperformance of such funds in a high-interest-rate environment but also due to political backlash from many right-leaning states.

As the sustainability rhetoric softens across markets and with Trump’s return, tech companies have more leeway at a time when their priorities are shifting toward maintaining momentum in AI. This will undoubtedly make it much easier for them to pursue natural gas as an energy source to power their data centers.

Updating Priorities

Big Tech companies have historically prioritized sustainability goals to maintain public image and investor confidence. However, AI-driven growth has shifted their priorities. With energy becoming such a critical bottleneck, companies are naturally turning to what is most easily available to ensure they don’t jeopardize their lead in the AI race—or risk being left behind. Investors may forgive companies for missing sustainability targets, but falling behind in AI? That would be their death. No shareholder will forgive them for that.

For Big Tech, owning the energy production pillar is all about reducing risk. Because energy is such an essential requirement for AI, having control over it should be an obvious conclusion. They have explored the possibility of Small Modular Reactors (SMRs) that could be placed next to their large data centers, allowing them to go off-grid. But SMRs are still at least a decade away from widespread deployment. A similar challenge exists with geothermal energy, which, while aligned with fossil fuel expertise, won’t be a major contender until after 2035.

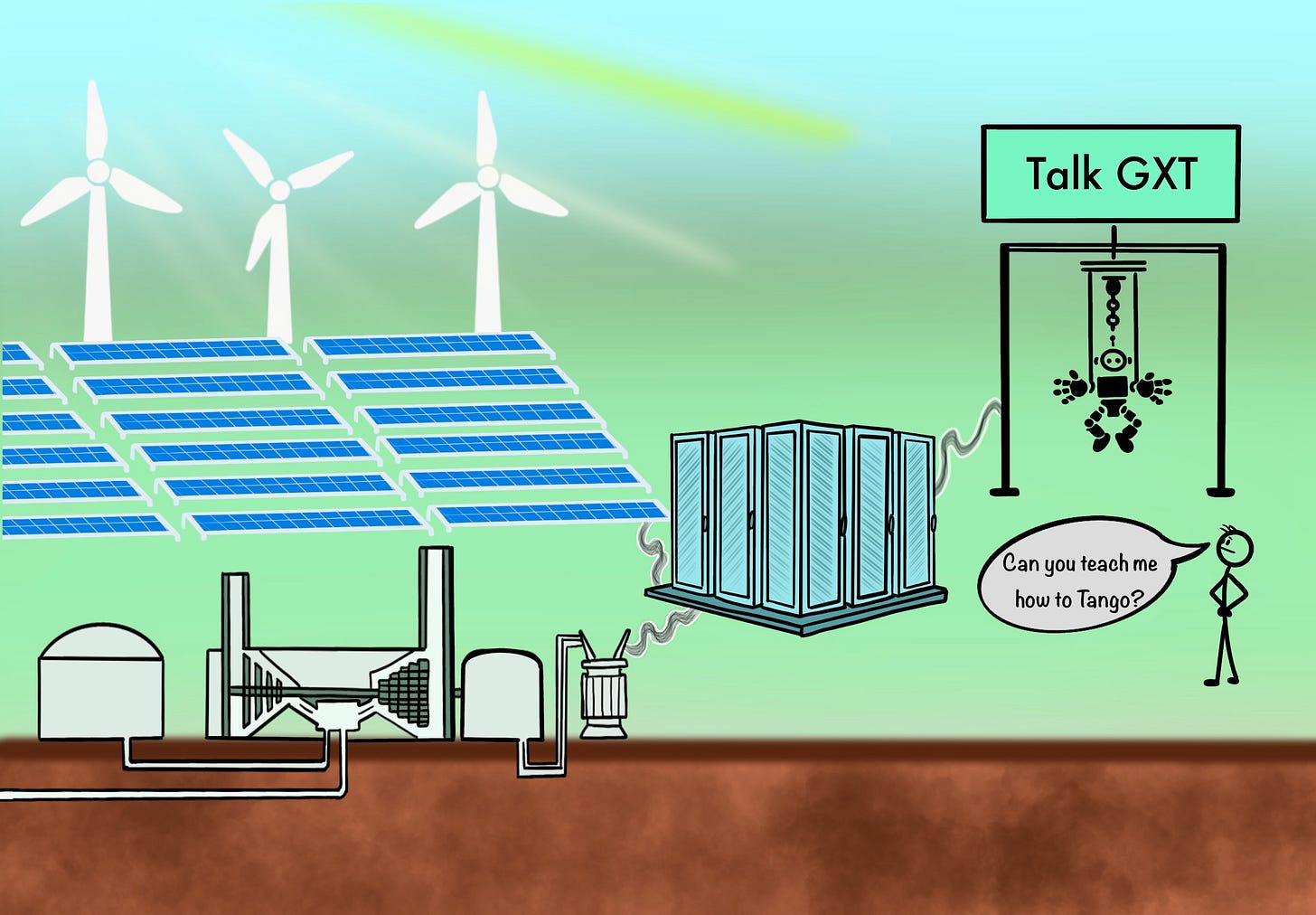

Meanwhile, natural gas has several advantages that Big Tech hopes to utilize to power their data centers. It can easily be bundled with renewables like solar and wind. In fact, using natural gas could allow Big Tech to place data centers next to large solar and wind installations, assisted by battery storage to manage intermittency issues. Intermittency is a serious problem for AI data centers, which prefer firm power, though some flexibility in their electricity use will undoubtedly develop over time. This, again, presents a solution for going off-grid.

Even current natural gas plants—which often sit idle except during peak demand—could become prime sites for data centers. By installing a mix of renewables and battery storage backup, and working alongside the natural gas plant, the data center could draw energy efficiently, without needing the grid. During peak demand, the natural gas power plant could prioritize general consumers while data center batteries could offset any renewable intermittency—or, in extreme cases, AI workloads could briefly scale back.

And while natural gas, as a fossil fuel, is often seen as “dirty” by purists, it can be made much cleaner. Natural gas power stations can capture and store CO2 emissions underground, essentially permanently. These plants can also be converted to run on hydrogen.

Blue hydrogen—produced from natural gas by separating CO2 before combustion—offers another viable alternative. Captured carbon from this process doesn’t have to remain a waste product. Through methane pyrolysis, natural gas can be split into hydrogen and solid carbon, which has industrial applications in rubber, paint, and even battery-grade graphite. With further innovation, this solid carbon could find broader uses, making blue hydrogen both an economical and clean future alternative to natural gas.

So rather than abandoning net-zero goals, Big Tech can use decarbonization levers within the existing natural gas infrastructure. This allows them to balance short-term AI growth with long-term sustainability commitments through carbon capture and blue hydrogen. This is not where part of the world wanted to go five years ago, but it might still offer a chance to keep moving toward this goal.

Green Future 2.0

Phasing out fossil fuels completely was always going to be difficult. You could shame the world into action. You could try to force its hand. But with so much of the world connected to this industry, a net-zero path that excludes it was never going to work.

Despite coal’s decline, the U.S. now produces about 50% more fossil fuel energy—coal, oil, and natural gas—than it did 15 years ago. Production has been growing at 3–4% annually for the past five years, and with Trump’s backing, that trajectory is only set to rise.

Even with increasing natural gas use, a path to net-zero remains. Carbon Capture, Utilization, and Storage (CCUS) and blue hydrogen offer near-term solutions. And with Big Tech prioritizing energy access while keeping sustainability objectives alive—at least on life support—CCUS and the hydrogen economy could see renewed vigor in the U.S. as natural gas production and consumption expand.