Could Geothermal Energy Redefine the Future of the Oil and Gas Industry?

How well does geothermal energy align with the oil and gas industry objectives?

Is Geothermal Energy a Lifeline or a Challenge for the Oil and Gas Industry?

The growing interest in geothermal energy should be seen as a lifeline for the oil and gas industry, which has thus far played a limited role in advancing the transition to net-zero emissions.

Just as hotels align with the hospitality sector and timely delivery with the logistics sector, drilling is intrinsically aligned with the oil and gas sector. It is no surprise, then, that if a new opportunity to harness energy emerges from beneath the Earth’s surface, oil and gas professionals are uniquely equipped to bring it to fruition.

But will the widespread availability of geothermal energy truly benefit oil and gas companies?

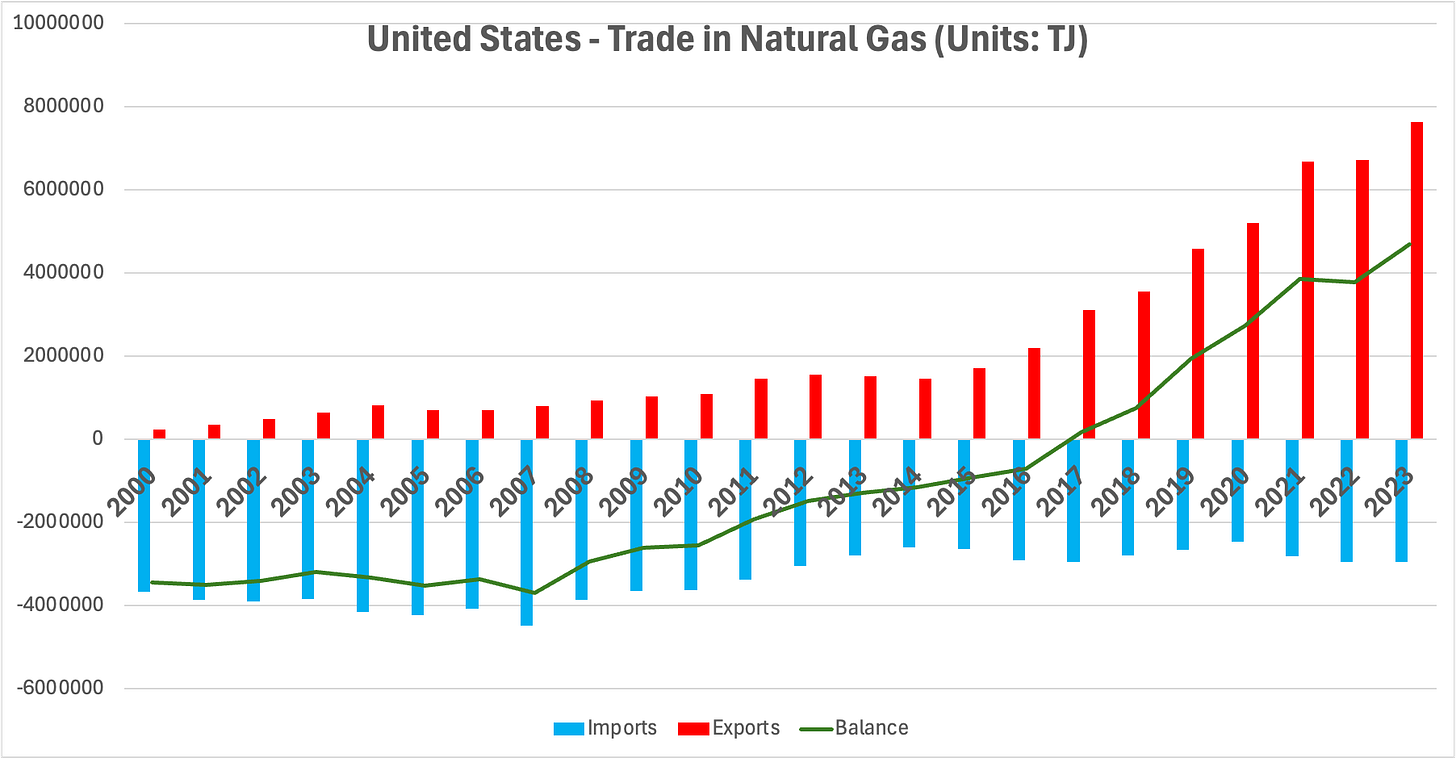

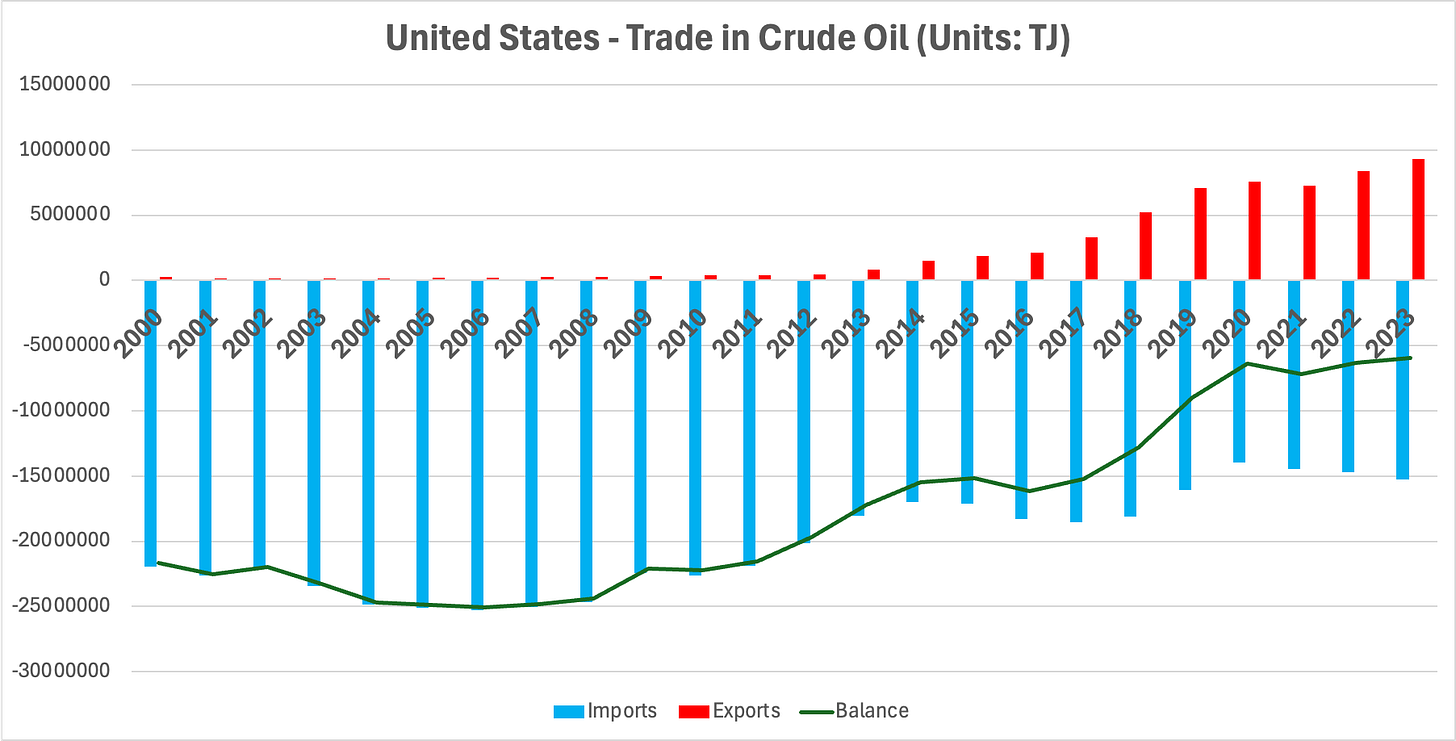

U.S. oil and gas companies, in particular, have positioned themselves as exporters of energy. The United States is already a net exporter of natural gas and has been increasing crude oil production over the previous decade to boost exports relative to imports.

The conundrum for the oil and gas industry is that while geothermal presents a significant opportunity to expand their business offerings and diversify revenue streams, it also introduces challenges. Geothermal energy is not a fuel that can be exported, which makes it less compatible with business models centered on growth through export markets.

Cost of Geothermal Energy

Next-generation geothermal energy is positioned to become one of the most affordable sources of dispatchable electricity in the United States. According to estimates by the IEA, costs could decrease by 80% over the next decade, bringing electricity generated from geothermal to around $50 per MWh. At this price point, geothermal would be competitive with—and often superior to—many other sources of energy. The U.S. Department of Energy (DOE) is even targeting a cost reduction to $45 per MWh without subsidies.

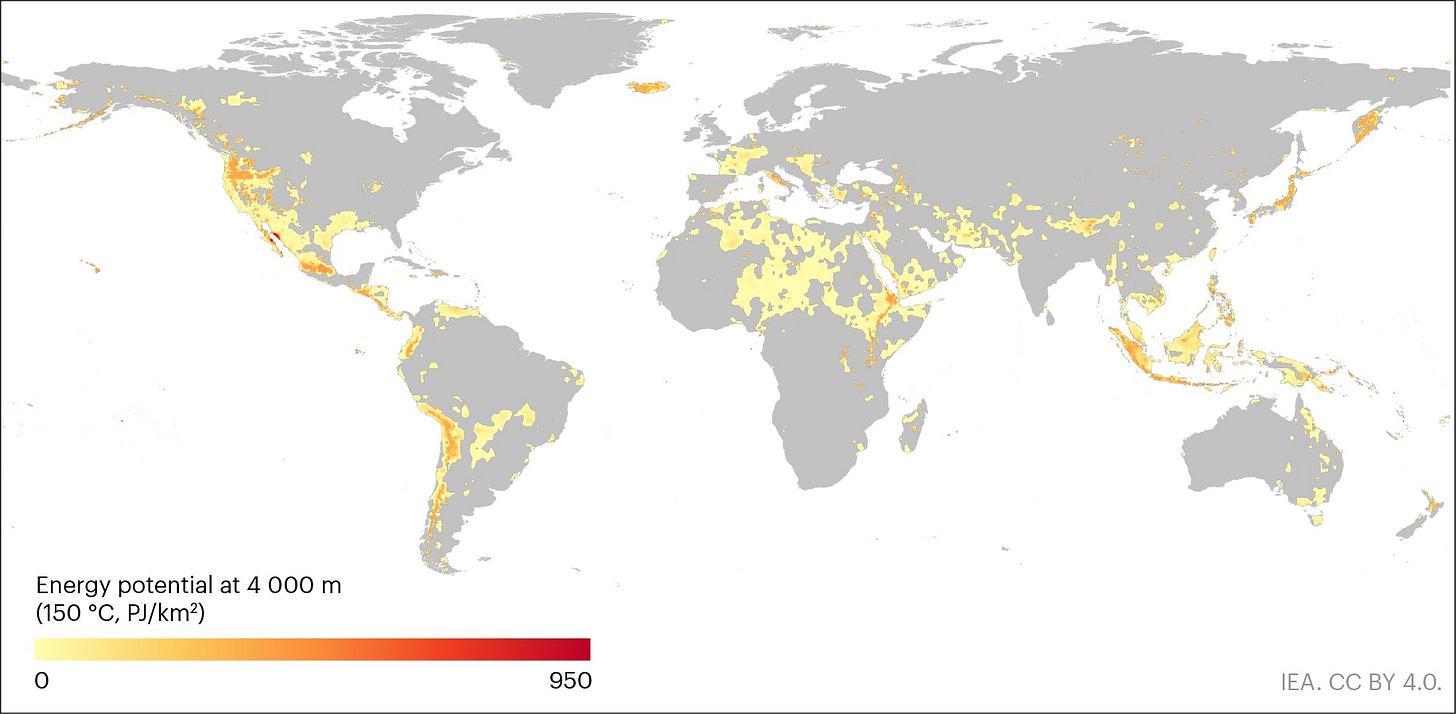

Costs will vary across the country, but in the western United States, where abundant geothermal resources exist at shallower depths, the cost of next-generation geothermal generated electricity may already be below this target. For context, the average wholesale electricity prices in the U.S. typically range from $30 to $60 per MWh. Among dispatchable power sources, next-generation geothermal could become one of the most cost-effective options. While its cost exceeds that of standalone solar, it becomes competitive when compared to solar paired with battery storage.

Because geothermal energy does not rely on fuel, operating costs are a smaller portion of the total cost, which is heavily weighted toward upfront capital expenditures. This parallels the challenges faced by large nuclear power plants, where high initial costs and project risks can complicate financing. However, geothermal offers a distinct advantage: the ability to expand projects incrementally, much like nuclear SMRs.

Large geothermal plants with multiple production wells can be built in stages, allowing electricity generation to commence even before all wells are completed. This stepwise expansion can make future geothermal projects easier to finance and manage. By spreading the significant drilling costs over time, this approach helps mitigate financial risks and better manage overall project expenses.

Exporting Hydrogen and Synthetic Fuels Made Using Geothermal Energy

While exporting geothermal energy directly is not possible, hydrogen-based fuels produced using geothermal energy can be exported. One of the key advantages of geothermal energy development in the United States is the accessibility of large geothermal resources at relatively shallow depths, making extraction more cost-effective.

The western United States boasts exceptional geothermal potential. In addition, the region west of the Mississippi River is rich in wind energy resources, while the southwestern U.S. benefits from abundant solar energy. Together, these resources create an opportunity for a significant portion of the country to leverage a combination of wind, solar, and geothermal energy to deliver cheap, stable, and clean electricity for producing hydrogen-based fuels. Due to the potential for inexpensive electricity in this region, hydrogen-based fuels could be produced at costs lower than in many other parts of the world. This competitive edge could drive energy trade, benefiting U.S. companies investing in geothermal energy.

Oil and gas companies are already positioning themselves to participate in the global hydrogen fuel trade, and geothermal energy would be a complementary technology for these efforts. Furthermore, cheap electricity is a crucial component for cost-effective carbon capture and storage (CCS), another area where oil and gas companies are heavily involved. Geothermal energy, therefore, aligns well with their strategies to diversify and innovate in the clean energy sector.

Geothermal energy could significantly reduce the cost of producing hydrogen. However, doesn’t the widespread availability of geothermal energy diminish the need for hydrogen? One might think that since power from geothermal is dispatchable, broad access to geothermal resources could reduce—or even eliminate—the necessity of hydrogen for long-term seasonal storage in the U.S.

Given the high upfront capital expenditure required for geothermal projects, achieving a high utilization rate is essential to keeping electricity costs low. This also means that building excess generation capacity solely to address seasonal fluctuations would be cost-prohibitive. While geothermal, in combination with other sources like nuclear, solar, wind, and hydro, could handle medium-term fluctuations effectively, long-term seasonal variations will still necessitate the use of energy-dense fuels.

An energy system designed to manage these long-term fluctuations will require sources where operational costs constitute a significant portion of the total project cost, as opposed to the high-capital, low-operational cost structure of geothermal projects.

In any case, hydrogen will still be essential for other applications.

Hydrogen and hydrogen-derived fuels have a wide range of uses. These include powering heavy-duty transportation, such as shipping and trucking, through fuels like methanol or ammonia, and air travel, using synthetic jet fuel. Additionally, hydrogen and its derivatives are critical feedstocks for the chemical industry. While the future size of the hydrogen industry is uncertain—largely due to its high production costs, which have been decreasing more slowly than anticipated—it remains a crucial component of achieving net-zero goals.

Although hydrogen’s role in seasonal storage may become obsolete in some countries, it would still be necessary in other countries. While geothermal resources are technically available everywhere at sufficient depths, not all nations have access to cost-effective geothermal energy. Deeper drilling becomes increasingly complex and expensive. This disparity means hydrogen produced using cheap geothermal energy in the U.S. could still find a market for long-term seasonal storage in regions where geothermal energy is less accessible.

As we move toward electrifying much of our energy use, new areas of energy demand emerge for oil and gas companies, even as traditional use cases decline. Historically, oil has primarily been used to produce fuel for cars, trucks, planes, and ships, in addition to its role in the petrochemical industry. However, the electrification of transportation allows other energy sources, such as renewables and nuclear, to capture market share from oil companies.

Geothermal energy presents an opportunity for oil companies to diversify beyond transportation, which has traditionally been their primary market. With geothermal, oil companies can supply energy for a broader range of uses, including electricity for AI data centers, consumer devices, and home heating. This expansion into electricity production enables oil companies to tap into new markets while adapting to a changing energy landscape.

Geothermal Energy Could Be the Preferred Choice for Powering Export-Driven Industries

At first glance, apart from hydrogen, geothermal energy does not appear to lend itself to being repackaged into an exportable product. However, this isn’t entirely true—indirect export opportunities still exist.

Instead of producing exportable energy products, regions with access to cheap geothermal resources could attract energy-intensive industries, producing goods that can then be exported. For instance, geothermal-rich Iceland is Europe’s second-largest producer of aluminum, thanks to its abundant, cheap, stable, and clean geothermal energy. Aluminum production is highly energy-intensive—requiring ten times more energy than steel production—making cheap electricity a crucial competitive advantage.

Similarly, affordable energy is a major asset for energy-intensive technology sectors, such as semiconductor manufacturing and AI data centers. Supplying cheap electricity to AI data centers in the US, enabling them to handle energy-intensive computations and export the results via fiber optic cables, mirrors the traditional model of exporting fuels to run data centers in foreign countries. Additional benefit for the country being that in this scenario, rather than exporting energy, the U.S. exports higher-valued services or products powered by its abundant geothermal energy.

Cheap, dispatchable, and distributed power from geothermal could foster the growth of energy-intensive industries in North America, positioning the region as a hub for advanced manufacturing and technology.

US as an Exporter of Deep Drilling Services

Another advantage the U.S. oil and gas industry holds is its advanced technical capabilities and low-cost drilling expertise, honed over the past two decades through the development of shale oil and gas extraction. These skills are particularly valuable for deep drilling, which could position the U.S. as a key provider of services in countries where geothermal resources are located at much greater depths.

Currently, oil and gas companies focus on building oil production and refining infrastructure and selling refined oil and gas globally to utilities and other users. With geothermal, these companies could expand their role by either acting as builders of geothermal plants for international customers or building, owning, and operating generation plants themselves. This shift represents a significant opportunity to diversify and expand their existing capabilities.

A major share of geothermal project costs lies in the upfront drilling process. This opens up two potential business models for oil and gas companies. They could serve as builders for large buyers able to finance such investments or take on the role of plant owners, supplying electricity to customers who may lack the resources to fund such projects themselves. This dual approach offers flexibility and a path to leverage their expertise in new markets.

Geothermal Energy as a Path to Net-Zero Leadership for Oil and Gas

The oil and gas industry has struggled to identify how its technical expertise in drilling, geographic analysis, and chemical engineering can contribute to achieving net-zero goals. The rise of renewable energy and electrification has posed an existential threat to their traditional business models. However, as they begin to diversify into areas like mining for battery materials, hydrogen production, and carbon capture and storage, geothermal energy presents another significant opportunity.

Geothermal allows oil and gas companies to embrace the transition to net-zero by leveraging their core strengths in drilling and subsurface resource management. Rather than being sidelined, they have the chance to position themselves as leaders in this transition. This shift not only enables them to stay relevant in a decarbonized energy future but also helps preserve the value of their primary expertise—drilling—ensuring it remains a critical and valuable skill for decades to come.

Read further: